This article is a reproduction of the Chapter 4 of the book "INNOVATING CENTRAL BANKS With New Mandate and Governance to Promote Safer Money and Banking in Open Economies" (pages 67-99) published by me through Sarasavi Bookshop in February 2019.

I feel that views expressed in the Chapter will be useful now as state authorities provide diverse promises to stabilize and recover the presently bankrupt state and economy of Sri Lanka soon and to secure the development country status in the next two decades whereas the instrument they use to deliver all these promises is the public service or the state sector, given its dominance over the economy and people. Although economists estimate the relative size of the state as the percentage of state budgetary spending in the GDP, the total impact of the public service on the economy is way above that number, given the nature of direct and indirect impacts.

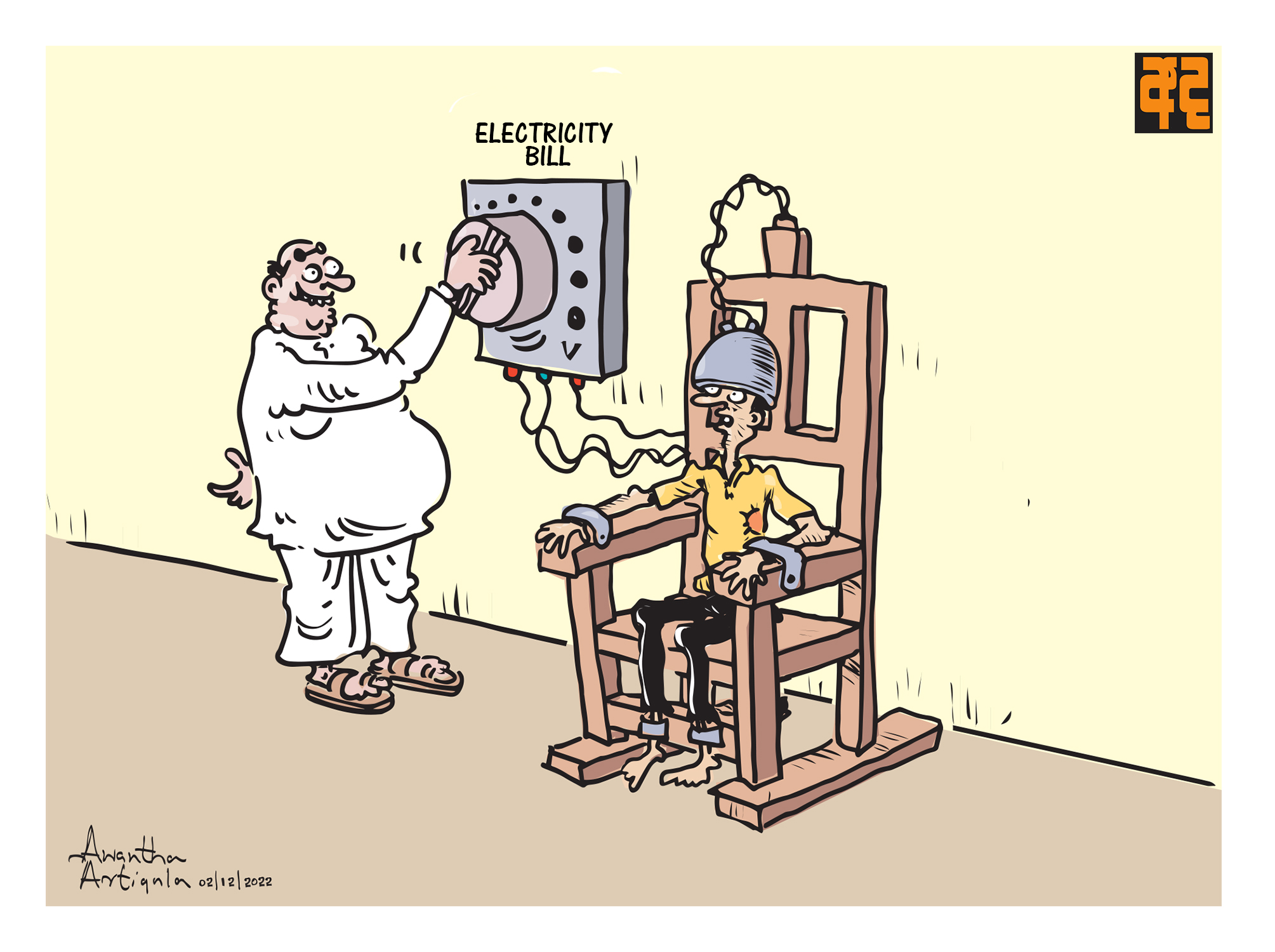

However, it no secret that the present economic crisis and bankruptcy (inability to repay debt and receive income to cover cost including default of debt in April 2022 and subsequent debt restructuring) of Sri Lanka were a result of same public service, especially central banking and state treasury management. Therefore, it is difficult for the general public to imagine whether same model of public service and state authorities could deliver on those macroeconomic promises.

The public service can be defined as a set of state interventions in the free movement of people in their living and civilization for broader interests of the society as the authorities deem fit within their ideologies. Accordingly, the public service comprises of all actions of the government, i.e., elections, laws, regulations, licensing, production and trade of goods and services. As the cost of public service is lower than its price or income to the state, budget deficit and debt prevail. The debt in turn is an important public service to create sovereign money required by the society. Therefore, whatever said and done by state authorities from time to time, budget deficit and debt are part and parcel of the modern monetary societies. Deficit and debt are necessary to supply sovereign currency demanded by the public. Therefore, zero budget deficits and debt are mad thoughts of modern political leaders and their servicing economists.

Therefore, the economy of any country is a politically decided economic governance system because there are no economic principles developed by independent economists to develop and manage a country to provide the general public with a specific or pre-determined standard of living. Therefore, values of political governance and the resulting system of public service are crucial for both bankruptcy and development of a country and living standards.

Therefore, the stabilization and recovery of the public from the present economic bankruptcy requires a government and public service newly designed for the purpose depending on the freedom given to markets. Otherwise, the government by now could have its Treasury and central bank economists to launch a macroeconomic plan to recover the economy and those same economists would not have bankrupted the economy in the present form in 2022. Therefore, the new idea that the economic recovery is an economic matter and not political is baseless. The economy people enjoy in any country is an outcome of the political ideology on the nature and size of public service. For example, present government follows the IMF ideology which is one approach to control fiscal deficit and debt while there are diverse ideologies on public service and economic management. Therefore, what matters is the choice and public outcomes and not the ideology per se.

In general, public service tends to flow on existing files, decisions and processes of the past resisting of changes or improvements. Therefore, any attempt to innovate or change any of them will be alleged as corruption. This shows that present form of public service delivery system will not help the recovery from a crisis as the crisis itself is a result of the existing lapses and poor quality of public service and authorities. For example, if the public services of the Treasury and Central Bank had been dynamic and innovative to deal with emerging needs of public services, the economic bankruptcy today would not have been encountered and the recovery would not have been so delayed.

Therefore, amendments to delivery systems are necessary to resolve root causes of the bankruptcy and bottlenecks of the recovery. The present mode of accounting-based amendments based on debt sustainability ideologies that are used for bankrupt business entities is highly inappropriate for public service sector of the economy which does not follow business accounting standards for financial operations. Therefore, the present mode of public service will never be able to deliver on promises of stabilization, recovery and development except number crunching.

In this context, this Chapter will provide fundamental understanding of why and how the state authorities should innovate the public service system if they are really interested in delivering on above mentioned public promises. The bad pubic perception of the state and public service common to any part of the world at different scales. The new talks on anti-corruption and governance are partly reflective of the overall poor quality of the state and public service whose details are limitless.

Accordingly, this Chapter provides a set of fundamental issues in public service delivery that can be useful to the authorities who are interested in innovating the system. Those issues are as follows.

# Price not Reflective of Cost and Market

# No Product Disclosures and Customer Service

# Public Employment Management without Regard to HR Views

# Non-Transparency and Non-Accountability of Duties of Public Authorities

# Prevalence of Chronic Corruption

# Doing Business Unfriendliness

# Non-availability of Socio-Economic Impact Assessment

As the Chapter was intended to cover central banking too as a public service, the Chapter provided following conclusions.

Central banking also falls into the public service and, therefore, almost all concerns and environment of public service are equally applicable to central banks too. The major difference here is that central banks have a greater operational and financial independence from governments as compared to other state/public institutions, given their monopoly to print money in the conduct of monetary and financial policies. Therefore, printing of money may be subject to enormous abuses including policy mistakes due to the flexibility of operations and strict confidentiality of information. Therefore, it is advisable that central banking authorities assess their processes adopted for policy-making and approvals falling under their purview to ensure that the public accountability and trust in the macroeconomic management role of central banks are upheld while minimizing the room for public concerns and allegations applicable to public service.

In review of public service or macroeconomic management and economic and social development in the world, the contribution of the private sector/markets made through inventions, technology, mobilization of resources, production and trade to the world, despite bureaucratic bottlenecks and red tapes, has been extraordinary. Certain corporate leaders have been behind this world development. When compared to how private markets produce inventions to further improve the quality of human life, the status of the public service with all mighty powers of the governments is pathetic, despite highly educated crowd of public servants

In fact, money, banking and central banking have been invented by the private markets. Therefore, the government must value and facilitate the on-going private market innovations in monetary front as the government cannot keep the money under its control as a part of public service. Innovations in money and banking also can immensely improve the quality of human life further.

Therefore, the Chapter as published in the book is reproduced below for easy reference of the interested readers.

INNOVATING CENTRAL BANKS

- With New Mandate and Governance to Promote Safer Money and Banking in Open Economies

CHAPTER 04

PUBLIC SERVICE IN MACROECONOMIC MANAGEMENT

Banking is a part of public service used in state economic management. Therefore, it is worth studying the broader outlook of the public service to enable to have an insight into central banks and to deal with underlying issues in the public interest. The public service is the state sector of the economy maintained for macroeconomic management. The foundation of the public service is the wider public interest and democracy which is intended to accrue benefits to the majority public through the state intervention in the society although some members of the public may be adversely affected by such services. The delivery of public service is the manner in which the state intervenes in the market mechanism and economic and social life of the public in various ways.

The state intervention in economic activities has been in the world from ancient civilizations. The school of thoughts against the state intervention is the laissez-faire that advocates for free market economies. Such thoughts were first published by Adam Smith in his books of “The Theory of Moral Sentiments” in 1759 and “An Inquiry into the Nature and Causes of the Wealth of Nations” in 1776. He presented the view of the “invisible hand” that regulates free markets which operate through competition, demand and supply induced by “self-interest”. People try to maximize self-interest or return for themselves without regard to common good, but the self-interest leads to produce the best outcome for all people because self-interest or profit has to be earned from satisfying the needs of others/customers. Accordingly, the invisible hand drives the stability/equilibrium in free markets thorough the price mechanism. The capitalism is the political version of free markets. However, parties who govern societies believe that free markets are not the best solution for the wider public interest and, therefore, they advocate for the state intervention in economic activities of the societies. Some present the view of social market economies to conceptually combine free markets and state intervention in the majority social interest. However, this is nothing but the old economic concept of mixed economic system whose ideal mix is not known.

The extreme of the state intervention or the opposite of the free market philosophy is the socialism that the state should run the economy through its bureaucracy. The socialist models of the state interventions have been phasing out in the world since 1980s although socialist views continue to remain in politics. Other than the economic philosophy, nobody has experienced completely free markets in the world as state intervention has been there from ancient civilizations through various means, i.e., taxes, business controls and state support. In modern economies, free markets mean allowing demand and supply forces to operate within certain state regulations while governments withdraw from state monopolies and price and quantity controls. Modern state intervention is carried out under a number of laws and administrative procedures as set out by the government from time to time in order to control various activities of the public. Such laws and procedures consist of a large number of enactments, rules/regulations and institutions which empower public officials to take decisions/interventions in respect of specified activities of the public. Such authority of public officials attracts a high social weight on them and could result in abuse of the authority by certain public officers in various manners which include bribery and corruption.

Broader categories of public service are registration or licensing of certain activities such as births, deaths, marriages, lands and construction of buildings, maintenance of law and order and national security and provision of certain goods and services such as petroleum, electricity, health, education, regulation, infrastructure, economic and social subsidies and national policies. The government incurs a cost to produce the public service. As the government is a system created by society or people to decide and provide such public service as appropriate, the society has to pay for the cost. Therefore, the government has to charge a price from the public to cover its cost of public service. This price is nothing but the tax which is broadly defined as all fees and charges levied by the government from the public.

All funds that involve in the government are the public funds that decide the size of the fiscal policy or financial side of the government. If the cost incurred in providing public service is greater than the price charged (or the government revenue), there is a deficit in public funds that has to be financed by the government debt raised from the domestic public and foreign investors. In recent five years of Sri Lanka, annual government revenue was 12% to 14% of the annual total income of the country (Gross Domestic Product). However, the total cost of public service was 17% to 20% of the GDP. Accordingly, annual borrowing to fund the fiscal deficit on the delivery of public service has been 5% to 6% of GDP. The fiscal deficit has been a major macroeconomic problem arising from the existence of the public service/public sector in many countries in the world.

Since the government debt also has to be repaid by the public through prices or taxes to be paid in the future, the government debt is the public debt. If the public is prepared to pay a matching price for the cost of public service today, there will not be public debt. As long as the fiscal deficit remains, the public debt will accumulate or multiply year by year. In such event, new debt will be raised to repay existing debt in addition to financing the cost of existing public service. Therefore, if the public debt level is not managed at levels sustainable within the resources or proceeds of public funds, the resulting debt over-hang will lead to far reaching macroeconomic implications to the public. The fundamental economic view is that if the government has to run a budget deficit, it has to be financed from savings of the domestic public by cutting down their investments. If the investments of domestic public are not to be affected, the country has to borrow from foreign public.

The critical point of the public service and public debt over-hang is the risk of default on public debt. There are various views to figure out the level of public debt sustainable in the respective countries. The fundamental that the general public and politicians must understand is that if they expect a package of public service costing more than the price/tax they pay, the accumulation of public debt will continue. If they want to reduce the existing level of debt, which is around 79% of GDP in Sri Lanka, they have to pay tax higher than the cost of public service so that the surplus tax income can be used to repay existing public debt. Otherwise, the bitter reality is that the debt problem will be never-ending. If it is assumed that Sri Lankan government maintains a fiscal surplus of 1% of GDP with constant GDP throughout the future, it will take 79 years or two generations to repay existing debt. Overall, as public service is not provided in a market environment, the overall price of public service is a controlled price below the market price and, therefore, the fiscal deficit and accumulation of public debt are unavoidable. As such, public debt accumulation is also a major macroeconomic problem confronted by many countries, emerging market as well as developed market, where some countries have even defaulted debt from time to time. Therefore, state debt default is also a market phenomenon happening from time to time.

There are various kinds of products offered under the public service. Some products may be provided in a market environment with competition, but not at market clearing prices. These include commercial products such as banking, petroleum products, postal service, transportation and telecommunication provided through state enterprises. Health and education are supplied free of charge or at lower prices although there is a private market for such services. Certain products/services such as registration, licensing and regulation are supplied though state monopolies, but prices could be considered as lower than the cost of service supply. Some other services such as irrigation, roads, police, security and judiciary are supplied though non-market state monopolies without a direct price and, therefore, the demand for such products should be significantly higher than the capacity of supply. In general, the quality of public service products is poor as seen from various delivery inefficiencies such as delivery delays, lack of customer care, bureaucratic procedures, irregularities and non-transparency. The low price also reflects the low quality. The quality difference can be experienced when a person visits a public entity and private entity for a similar service. It would be a good state management information system if the government can compile a list of public service products with respective unit cost and price and assess the need of such services to the society along with relevant service delivery cost in order to resolve problems of the fiscal deficit and debt problem at least in the next generation.

All public service institutions have been incorporated with certain legal authority, functions and powers to intervene in specified activities of the public. The employees or servants of those institutions (public servants in general) have been entrusted to exercise such authority through legally prescribed procedures and/or procedures stipulated by the relevant public servants themselves under relevant laws or administrative procedures relating to those services. Public servants irrespective of their grades are highly reputed persons in the society because decisions made by them at various stages of delivery of public service (supply chain) are tantamount to different levels of intervention in public life relating to respective activities. The quality of public service also depends on the knowledge, skills and views of those public servants, availability of required resources for maintaining service outlets and underlying service delivery procedures. Therefore, public servants or employees are responsible for the delivery of public service and the effectiveness and efficiency of the cost or public funds. As a result, public servants are subject to certain standards of employment where they can be punished in various ways for irregularities or violations of public service delivery standards even after their retirement.

First, transparent standards are applicable on recruitment, remuneration, promotion and retirement in terms of public policies/administrative procedures in contrast to private sector. However, political interventions are not unusual in recruitment and promotions. In general, employment opportunities in the public service are supposed to be open to members of the public who meet with certain national education and personal qualifications. Second, transparent standards are applicable to the conduct of public servants. Some of them are disciplinary inquires on the misconduct on the job or in office and non-compliance with service delivery laws and procedures, prohibition of bribery and corruption and certain requirements of moral integrity such as unbiasedness, honesty and efficiency and economies of public funds. Third, public appeal process is applicable to decisions made by public servants. This process even extends to the Judiciary inclusive of fundamental rights applications to the Supreme Court. Effects of such appeals will be even on retired public servants in relation to their conduct during the job. Fourth, democratic principles govern the public service.

The foundation of the public service is generally the wider democracy which is intended to bring benefits to the majority public although some members of the public may be adversely affected by such services. Therefore, public servants must understand and feel basic democratic principles when making decisions on public service delivery. The origin of the public service today is the British bureaucracy and administration in the majority interest of the public where procedures to promote fairness in decision-making are well-respected. This is an essential part of the democracy and, therefore, the public servants must understand and respect such democracy when delivering public service. Otherwise, public officials tend to easily become authoritarians to the general public. As such, there is a large number of pressing issues relating to the quality and fairness of the delivery of public service irrespective of the country. Some of them are highlighted below.

Price not Reflective of Cost and Market

In most public service products, the price does not reflect the cost. Therefore, the demand at lower price is naturally very high where the public authority cannot supply the service in full to meet the demand. As a result, public consumers compete with each other through non-price means that lead to various abuses and irregularities in the manner in which certain public servants deliver services. For example, there is always a tendency that consumers look for help of various parties known by way of relations or friends or influential politicians to those public servants to get the priority in attending to those consumers. The greater the connections found, the speedier will be the receipt of the specific service sought. Such connections are always linked to offering various gifts by way of money and non-money benefits to those public servants and connected parties/intermediaries for the purpose of getting the service delivered with priority and, in some cases in non-compliance with the procedures. Bribery and corruption are referred to such gifts. Although considerable punitive measures are available to stop such gifts, bribery and corruption take place in almost all countries world-wide. Such bribery and corruption are considered as a major hurdle preventing the development of many emerging market economies. Instances of bribery and corruption are experienced in developed market economies too. Therefore, public institutions may have to price their service products considering the cost and demand and supply conditions.

Some public services such as regulation and law and order are consumed without a direct payment of a price paid by consumers. However, if a person seeks specific service, its actual cost or price to be incurred by the person individually could be higher than the official price/fee in some instances. For example, if a person goes before the legal system to seek justice, the cost is enormous by way of legal fees and difficulties confronted in the legal process. Although the legal system is presented to be fair by every individual, such price or cost incurred is not fair as the legal market is not transparent and competitive. Therefore, the number of consumers that come forward to buy a specific service of law and order could be very limited. In the case of most public services, the actual price/fee paid by consumers will be much more than the official price due to the non-price costs such as bribery and other costs of delays.

Problems in Public Service Delivery System

The service delivery system is essentially non-market based, given the nature of state monopolies and authority. Each service has its own delivery system. Most systems originate from legal provisions approved by the lawmakers. Certain legal provisions are diversely interpretable to suit numerous circumstances. There is a large number of circulars and written instructions in respect of implementation of certain legal provisions. Such circulars and instructions are known as rule books and operational manuals. In addition, there are various long-carried practices of ways of doing things due to whatever reasons in each public institution and such practices without any documentary evidence/sources have become a part of operations.

The fundamental weaknesses of the public sector are connected with these laws and procedures. They are complex and non-transparent even to those public officials. It is very difficult to obtain an updated set of laws and procedures in documents as there is hardly any updating process. These are not reviewed periodically to suit new needs of the public and economy. Even if some officials attempt or take initiatives to review them in the new context, the majority public servants including some political leaders publicly oppose them. One reason could be the experience that such attempts of reviews often have been targeted to favour a segment of known persons whereas public servants who take such initiatives with genuine interest of facilitating the public in general are rare. Another reason is that the prevailing systems are well-established to provide undue incentives to influential segments who are involved in the service delivery system and their incentives are at risk if the system is revised. In many instances, reviews of existing procedures are easily prevented by legal advisors who call for amendments to governing statutory provisions for effecting new procedures as it takes a painful bureaucratic process that takes years and years to pass any amendments to relevant statutes. Also, any genuine initiatives will involve in a lot of hard work to counter challenges and opposition and these initiatives are not considered as a part of performance evaluation of public servants. Therefore, almost all public servants are rather happy to maintain the status quo and stay non-stressful in office.

Once public service delivery system stays quite long-time without any periodical review, it requires a significant public force to change it which is called “reform”. Reform is a life-threatening exercise to those who undertake it and they rarely survive of allegations on corruption. The key problem here is the difficulty to understand what is good and what is bad for the majority public as any policy change causes both good and bad results. Views expressed for both sides of good and bad are seen fair and valid on the face of it. Therefore, the public servants who are authorized to make decisions are compelled to take enormous risks in taking decisions that they think appropriate. The issue is whether there are public servants who are not afraid of taking such risks may even end up in jail or lose their public careers at times.

In the case of public duties applicable to regulatory services, rule books and procedure manuals easily get outdated as private markets become innovative in products and business models despite regulations. The innovative business products are invented to circumvent the rule books and new forms of business risk-taking not detected or monitored by regulators come into play which will end up in creating business crises costly to the general public as learned from the past financial and banking crises in the world. An inherent lapse in regulatory public service is the daily-8 hours-based job with defined remuneration as compared to the market managers who are working day and night with performance/results-based remuneration. While regulators sleep over night, same night is adequate for business managers to make a major change in the market conduct. This change could be the beginning of a major market bust or a boom which regulators have no idea. Therefore, it is generally recognized that regulators eventually fail sooner or later. In this context, models of market regulation by markets themselves are being experimented in some countries. In such regulatory models, business disclosure requirements and transparency play a key role to ensure that market participants receive information to assess risks underlying their transactions and take only risks that they think prudent.

Two key conflicts of interest arise in public service delivery system. First, parties related to or well known to senior public servants undertake businesses falling under the purview of those public servants or take up leading positions in those authorities. As a result, such public servants tend to offer favorable treatments when taking decisions involving those parties. Avoidance of such conflict of interest is to be managed internally by those public officials and parties through their integrity and principles. Second, conflicts prevail among certain public services with regard to respective objectives and policies. For example, authorities implementing economic growth policy through industrialization will conflict with the environmental protection authorities. In many public service areas, especially approvals and registrations, such conflicts make businesses impossible as supplementary approvals of several authorities are required before the final approval is granted to commence a business. Therefore, instances of such conflicts of interest have been the source of many irregularities, questionable transactions and bribery and corruption in public service.

No Product Disclosures and Customer Service

The disclosure of information relating to how the public should place their orders/applications or requests for services is not customary in public institutions. In most cases, the application has to be submitted with a set of original documentary information that includes approvals of a host of other public services as preconditions. Further, when a person enters a public institution seeking particular services, no information is available or disclosed on where to go and what to be done. Even if an information officer is seated, either the officer is inundated with work or is not provided with basic details required from an information officer. As a result, public have to go around the offices inquiring from whoever public servants they see around and, therefore, public servants also waste a lot of time by giving out certain routine information to the visiting public during the day in addition to their respective jobs. Further, the public consumers have to visit the entity or connected public institutions many times by wasting time and resources. Even after completing necessary documents, it will take several months to deliver some services. Therefore, the price incurred by the consumer is much higher than the price paid for the particular service. Accordingly, if the price can be fixed in terms of the cost for the quality service, the market forces will reduce the demand where certain public services can be provided more efficiently and productively. For this purpose, each public institution has to cost their services while adopting efficient delivery channels accordingly by keeping a profit margin to build a capital in order to provide for service expansion without borrowing.

Public servants are not customer-service-oriented as they have the authority to decline applications of public consumers or give enormous troubles to them by requesting various additional information in connection with their service applications. In some instances, additional information is aimed to turn-down service applications or encourage routes of bribery indirectly. Public servants allocated to respective public institutions are not decided by the managers of the institutions. Instead, appointments, promotions and transfers of public servants are mostly decided by another set of supervisory authorities on the basis of external factors. Therefore, managing authorities often do not have the full control over the subordinate public servants. As a result, innovation on service delivery mechanisms and consumer care is missing in public institutions. It is widely known that service delivery mechanisms of public institutions are very old and rigid (known as red tapes).

The public servants normally do not think of reviewing or revising such mechanisms in line with new developments and they just tend to adhere to whatever they have been doing. Innovations and revisions normally lead to allegations on corruption. Most public servants do not think that they are there to serve the public, but they think that they are in respective jobs as privilege for their competitive educational qualifications or other merits. As a result, most public servants are not concerned about the consumer care or service innovation. However, in any public institution, there is a handful of public servants who make genuine efforts to understand grievances of the public and serve them with care within their decision-making capacity despite risks of allegations of bribery and corruption. It is highly undemocratic and inhuman if public services are mandated while public authorities are unable to serve the public consumers who seek such services due to such mandatory requirements.

Public Employment Management without Regard to HR Views

Recruitment of public servants at various grades is based on certain national policies open to eligible public. While some are competitive recruitments, some recruitments are linked to political decisions, subject to compliance with minimum standards of qualifications. Most top-level management positions are political appointees. Once they are recruited, their remuneration, conduct and promotion are also governed under specific procedures. Officers are required to carry on duties assigned to them under the procedures or specific legal provisions. Other than certain disciplinary inquiries in respect of defined instances of misconduct, performance on duties is rarely assessed as such performance appraisals have no major role in career development and promotional and remunerational prospects of public servants. Institutional jobs are considered as group-based where the contribution of specific individuals cannot be separated. Unless there is a serious misconduct proved beyond any doubt through a rigid and time-taking inquiry process, a public servant cannot be differentiated for performance purpose and, therefore, equal treatment in employment should be given to all. Any specific decisions unfavourable on employment conditions of public officers could be challenged in the judiciary on grounds of fundamental rights and natural justice. In this regard, immediate measures of trade union actions and petitions to Parliamentary Committees are immediate resorts.

Therefore, HR management views and arrangements are difficult to be applied in public service to encourage and reward highly performing public servants based on defined job descriptions and deliverables. Since innovation is not a subject practiced in public service delivery on a regular basis due to rigid nature of service delivery systems, HR views as in the case of private sector business management have no place in public service. This is well justified by the fact that no leading CEOs or management experts are found from the public sector in HR literature. In fact, the HR literature is made of success stories and strategies of leading private sector business CEOs who make historical performance to respective businesses through innovations. However, public officials who preserve the existing delivery systems and perform in non-controversial manner are treated as best officials with high integrity. Even if some public officials are given training on HR strategies based on private sector practices, they never try practicing such strategies in public institutions as the management environment is completely different.

Officials who take initiatives to innovate or reform are seen as troublemakers and caught in the media reports with allegations which may end their careers in public discredit. This is the reason why governments look for ownership-divestiture models to privatize some public services of commercial nature in order to improve the quality, competitiveness and cost-efficiency of those services. However, such reform models also are difficult due to protests by opposition politicians and trade unions which will end up in destabilization of even strong governments. Public interest litigation can prevent such privatization of state enterprises on numerous reasons. For example, such a privatized state enterprise in Sri Lanka was returned to the government after several years of private ownership and management, consequent to a supreme court judgement on a public litigation whereas the key public officer who handled the privatization was labeled as unfit and improper to hold public positions due to a lapse found in following the privatization procedure. The danger is that any concern over public service management is labelled as links to/allegation over bribery and corruption where alleged public officials find it very difficult to get free even if they are genuine.

The innovative and business-minded leadership is not available in the public service. The leadership in businesses always looks for results in terms of business models and financial outcomes. In that respect, innovation or improvements take place regularly. However, the political leadership in the public sector focuses on results of popularity and winning the elections again. The frequent tendency of the leadership is to preserve the prevailing systems. Even if they enact new legislations for public sector reform to produce new results, implementation takes long time due to lack of initiatives by the public servants who like to preserve existing systems. Reforms or improvements are always disputed with allegations of corruption. Even if reforms are implemented, good results are not appreciated due to side effects which are bad for some segments of political leadership. In some public services such as health and education, good results are difficult to be measured as such results are connected with economic and social conditions which cannot be separately identified. Further, good results are debatable due to bad side effects.

For example, in China, the single child policy adopted during the past 35 years produced positive results for population problem. However, resulting aging population has created new social and economic problems and, as a result, the Chinese government changed the single child policy to permit two children in 2016 and started discussions in May 2018 to remove the child birth limit in the future. In Sri Lanka, free education and expanded facilities for higher education have created a new problem of high unemployment of educated youth since the economy is not prepared to absorb such educated youth for employment. In state governance system, political appointees come from various think-tanks divided broadly among leftists and rightists who never like to compromise. Extreme leftists see all reforms as bad and corrupted while criticizing all existing systems as well. If opposition political parties are strong, reform/innovations and results are always delayed and difficult.

The public servants comprise of both political leaders elected by the public and state employees on regular cadre. Conflicts between the two segments prevail due to many reasons. In early January 2018, at a press-briefing on tax-cut legislation and deregulation agenda, the President Donald Trump referred to public servants in regular cadre as “unelected bureaucrats.” Politically appointees work on short-term policies to serve specific categories of the public with the intension of securing votes at the next election. They are either not knowledgeable or careless on financial controls and administrative procedures. Instead, regular public employees attempt to adhere to financial controls, rules and procedures. Most of the time, politically appointees pressurize regular public servants to deviate from procedures in order to deliver services in the manner they wish. In the event public concerns are raised on possible irregularities and corruption, the blame is invariably passed by same political appointees to regular public servants as to why they did not comply with the due procedure when adhering to instructions and views of the politically appointed masters as they knew those rules and procedures well. Therefore, there is inherent inefficiency in public service due to this separation and conflict between the two categories of public servants. This is the major problem confronted in economic management in many emerging market economies.

Non-Transparency and Non-Accountability of Duties of Public Authorities

This prevents the general public from assessing the performance of public service markets and accountability of public officers. The statutory confidentiality of information helps public officials to hide their true nature of performance. In most central government departments, even annual reports are not released to the public and, therefore, even general performance information is not available to the public in regular intervals. In that respect, media news created with the help of certain whistleblowers who leak information with malicious personal and political intensions leads to internal disputes and considerable operational risks in those institutions. In this regard, provisions of Right to Information Act, No. 12 of 2016 in Sri Lanka facilitate some access to information of state authorities while the confidentiality of certain information such as credit, banking, exchange rates and international trade dealings is preserved. However, in the event a citizen’s request for information from a state institution is turned down by the institution’s authorities, the appeal process is highly legalistic and frustrating. Nevertheless, provisions of this legislation help public officers to change their confidentiality mindset and rethink of public accountability and transparency of their operations and conduct.

Public services such as regulation and supervision of certain economic activities are provided to keep the respective sectors or economic conditions safe, sound and stable in order for the general public to carry on their activities. The relevant authorities have both goal independence and instrument independence in the respective regulatory and supervisory areas under a broad legal framework. The failure of such authorities has wide consequences on living standards of the general public in terms of public funds utilized to restore the sectors in times of crises and social cost in terms of the lost wealth and living conditions of the public. In such instances, the authorities while trying to cover up the lapses of the authorities often blame the general public for their failure of not being adequately prudent in preventing their risky behaviours. However, there is no system for the authorities to be publicly accountable for such lapses.

In instances of litigation on administrative decisions and alleged failures of public duties, principles of public trust doctrine are applied to punish public officials rarely. However, no public officer is knowledgeable on what public trust principles are applied to the duties of respective officers for which a large number of internal processes and institutional cultures/practices is applicable. No procedures lay down the principles of public trust doctrine that are applicable to respective duties and who are responsible for the public trust in the event a trust breach is established in respect of any public decision. In general, formally authorized decision-makers should be responsible for the public trust as the line-officers below are to implement such decisions, given the bureaucracy of the public institutions. In certain instances, some officials who implemented decisions get penalized in various ways, i.e., years of rigorous imprisonment even after retirement in some cases, at the end of legal battle. Such instances are frequently reported after change of political governments as part of retaliation on former state administration on various accounts with the help of state legal professionals.

Prevalence of Chronic Corruption

The corruption is a key challenge confronted by governments world over in orderly delivery of public service. The corruption could be broadly defined as irregularities that are involved in the delivery of public service outside the due procedure that are in place of respecting democratic principles, fairness and impartiality. In general, the irregularities that form corruption include a wide network of affording undue advantages to various parties on the delivery of public service. Various types of special treatments and undue financial benefits received by influential persons connected to the incumbent government and public officials causing additional cost/loss to public funds are the outcome of the corruption. The low level of supply of public service at low prices as against the high demand, bureaucratic procedures and monopoly and authority of public service delivery channels are some of fundamental causes that give rise to the corruption.

Some sources of undue financial benefits accrued as part of the corruption are bribes, commissions, stealing, manipulations of state cost and revenue and manipulation of remunerations. According to some analysts, the low level of remuneration to public officials not sufficient to maintain their living conditions at par with private sector counterparts is also contributory to seeking benefits through corruption, especially bribes and gifts. The large public sector prevailing as a result of politically induced recruitment of employees on a large scale poses a major constraint on the fiscal front and prevents offering suitable level of remuneration to state employees. In addition, strong labour movement also fights for lower differences of salary scales among employee ranks, despite wide differences of their skills, public duties and responsibilities.

State tenders/procurements are the most-known source of undue financial benefits, despite lengthy bureaucratic procedures and controls implemented to prevent such benefits. There is a wide network of middlemen that facilitate corruption in the society. Political agents, lobbyers, parties sponsoring political/election campaigns and friends and relations of authorities are some of them. In the background that all pollical campaigns are sponsored and financed by a large number of persons and parties ranging from large corporates, businessmen, wealthy individuals, investors and wealthy professionals who expect benefits in return once candidates and political parties come into to power, no governments can practically be free from affording or facilitating favourable treatments to such sponsoring parties. In most instances, such parties provide financial contributions to agents of all leading political parties who contest elections with the hope of receiving benefits from any political party that may come into power. As such, elections also are conducted based on possible inputs to corruption.

As a result, grounds for corruption originate from the very beginning of election campaigns which are big spending projects. Therefore, parties who make promises to eradicate corruption if they come into power are in fact making false promises to the public as they know very well that they have to treat their sponsors and well-wishers once they come into power. In general, new policies and reform on exiting policies of any new or existing governments are always alleged that those are attempted to favour their supporters. Even though all criticize existing policies, all rally against any new policies or reforms by making allegations of attempted corruption. In general, there is a group of parties who make living on existing policies and, therefore, they use all sorts of lobbying and inducements to protesters to prevent implementation of new policies or reforms.

As such, corruption is a live component of the governance systems of the countries with roots from the top level of the governments to all corners down within the public sector and society. Recent reports from Pakistan, South Korea, Brazil, South Africa and Malaysia are good examples for the high level of corruption that prevails in the world. It is known that if the corruption is blocked or prevented in any state activity, the activity becomes virtually inactive. It is also known that a successful business will never emerge or survive unless it is supported unduly by some elements of the bureaucracy. Therefore, business community always attempts to keep a network of connections to state officials. Payment of taxes and custom duties and business licenses are the two most-known public service areas that are involved in creating undue financial gains to businessmen and certain public officials at a cost to the state. No public official virtually can stay without being caught by the network of such business community.

A network of lawyers, accountants and professionals is operative to help such business community in preparation of technical documentation to avoid or minimize taxes and fees due to the government and to facilitate getting business approvals since public service documentation contains a lot of cavities and interpretable elements. Accordingly, although the price paid by the public for the public service is considered low, the actual price inclusive of the corruption on the delivery of public service will be financially and socially very high. The high fiscal deficit and resulting public debt in many countries are partly due to the reduced revenue and the increased expenditure as a result of prevalence of a wide network of corruption in the public sector. A part of public debt is also due to the corruption connected to market manipulation assisted by a set of public officers on the issuance and trade of government securities.

All countries have anti-corruption legal systems as an integral part of good governance within the public service. However, the failure of anti-corruption arms themselves due to the excessive prevalence of corruption world over in countries is not a secret. Most of investigations into reported corruption charges do not generally proceed regularly due to complications and lack of resources while convicted cases mostly involve in small bribes received by low ranks of public employees. Generally, investigative authorities do not receive required financial and technical resources from the successive governments. The combination of audit, investigation, prosecution and judiciary to convict a case is seen extremely difficult due to differences in their own procedures, operations and priorities. However, if the governments wish to convict certain persons in revenge, the convictions are effected in quite rush. Such convictions are mostly seen in the case of certain high-ranking public officials who attempt to be independent in implementation of certain state-directed policies which could be linked to irregularities or instances of corruption. In general, the greater the state control, the larger is the corruption.

The Corruption Perception Index compiled and released by Transparency International provides rankings of prevailing corruption in countries to help the global public and investors to understand the comparative levels of corruption prevailing in different countries. The index is compiled on the basis of assessments made by experts and business executives on several corrupt behaviors including bribery, diversion of public funds, use of public office for private gain, nepotism in the civil service and state capture based on 13 public data sources. The index covers scores between the highest corruption at 0 and clean at 100 and provides ranking for nearly 180 countries and territories.

According to the index, more than two-thirds of countries falls below the middle score of 50 showing the corruption problem in the world. Western Europe which operates in advanced democracy and market mechanism enjoys low corruption with an average score of 66. Sub-Saharan Africa, East Europe and Central Asia are the worst regions with an average score close to 30. According to Transparency International, the majority of countries are making little or no progress in ending the corruption. Although there can be technical issues in compilation of the index in relation to assessments and data sources, there is no major disagreement that the corruption is a leading cause for the low status of economic development of many countries as it prevents or distorts the market mechanism of doing business and benefits of democracy. Although the corruption is identified for the public sector, there is no doubt on the corruption prevailing in the private sector too because the corruption operates in a chain across the society. The poor transparency of operations and information is the key factor that keeps the corruption uncontrollable in countries.

Doing Business Unfriendliness

It is widely recognized that various state approval services that involve in the conduct of business in the economy are not business-facilitative and they in fact hinder businesses. Such approval processes that involve in long delays and explicit corruption are considered as a major hurdle in development of countries as well. Therefore, new governments always start fighting such corruption and trying to expedite business approvals. So-called public sector reform agenda inclusive of commercialization and privatization of state enterprises and services that are implemented to promote business environment while reducing the bureaucracy generally tends to fail due to various allegations and opposition political protests. However, opening economies to private sector and international competition since 1980s has been a great reform to public service-dependent economies although the process has been very slow due to same reasons. The closure of inefficient/loss-making state enterprises, privatization of commercially viable state enterprises, removal of price and trade controls and liberalisation of foreign capital flows are some of the key reforms that took a few decades to implement and, as a result, the whole world is benefitting from moving to the market-based economies. However, state approvals granting systems still operating with corruption and bureaucracy hamper doing businesses in many countries and prevent foreign capital inflows.

The World Bank has commenced compiling and publicizing an index called “Ease of Doing Business Index” to guide investors and state authorities on the levels of business friendliness of country authorities and to follow up on the countries with the low index to rationalize their public approvals processes in order to improve the index and promote business facilitation. The index is based on the average of 10 sub-indices representing various categories of business approvals and facilitation as listed below.

Starting a business – Procedures, time, cost and minimum capital to open a new business

Dealing with construction permits – Procedures, time and cost to build a warehouse

Getting electricity – procedures, time and cost required for a business to obtain a permanent electricity connection for a newly constructed warehouse

Registering property – Procedures, time and cost to register a commercial real estate

Getting credit – Strength of legal rights and depth of credit information

Protecting investors – Indices on the extent of disclosure, extent of director liability and ease of shareholder suits

Paying taxes – Number of taxes paid, hours per year spent preparing tax returns and total tax payable as a share of gross profit

Trading across borders – Number of documents, cost and time necessary to export and import

Enforcing contracts – Procedures, time and cost to enforce a debt contract

Resolving insolvency – The time, cost and recovery rate (%) under bankruptcy proceeding

Almost all areas above represent certain public services that affect doing business in countries. Further, there is a host of other public services that involve in granting various state approvals for doing businesses. In fact, it would be extremely difficult to compile a full list of all such approvals that are administered by various state authorities in relation to doing businesses and, therefore, a large number of businesses in fact may be operating without such approvals. The Ease of Doing Business Index stands at 1 for the best and the index rises for lower rankings. In early 2018, the best ranking (1) was for New Zealand and the worst (190) for Somalia. The highest ranked five countries are New Zealand, Singapore, Denmark, South Korea and Hong Kong, respectively. The US and UK were ranked 6 and 7, respectively. Although numerous initiatives and dialogues have taken place among the country authorities of emerging market economies to improve the ranking, no material improvements are observed in the rankings of many countries. Most of initiatives are the conferences among the business leaders and bureaucratic leaders convened by political leaders to exchange ideas which will not proceed further and things get back to square after conferences.

The non-adoption of modern IT systems in public service management is a major factor that causes poor quality and inefficiency of the public service resulting in low ranking of doing business. It is not a secret that the IT is the leading factor that promotes innovation, productivity and performance of the private production sectors in the world. However, the IT usage in public service is behind a generation. Although many governments have commenced talking about e-government systems where public services, especially approvals and registrations, will be provided within an integrated e-governance platform country-wide, even computerization of individual public institutions and their operational information has not happened. The public service delivery system has mostly been maintained through physical documents and mail which cause all sorts of concerns on chronic delays, low productivity and inefficiency of public service. While certain procedures such as audit and legal requirements are partly responsible for this environment, inflexibility of procurement procedures, lack of financial provisions and fear of loss of employment opportunities also have added to the problem of slower phase of IT applications. If public service deliveries can be modernized with ICT, a major part of concerns can be resolved as services can be followed up and monitored on IT platforms.

Non-availability of Socio-Economic Impact Assessment of Public Service

All public services end up in the government budget by way of income, expenses, borrowing and national economic and social policies. Countries rarely have surplus budgets. In economics, the budget is the top macroeconomic policy or the fiscal policy implemented to influence the aggregate demand (total spending on consumption and investments) in the economy for promoting growth, employment, resource utilization, etc., and setting the socio-economic policy of the country. The other macroeconomic policy assigned to the central bank is the monetary policy to regulate the monetary side of the economy for same economic objectives, generally independent of the government, but with close coordination to avoid policy conflicts and adverse budgetary impact. Within the overall public service, there are various micro elements that cater to socio-economic condition of the countries through taxes, subsidies, policies, regulations and state business enterprises which have direct and indirect impact on budget.

However, the government does not have an arm to assess the socio-economic impact of the public service and budget including the debt. Most economists and analysts criticize both the budget and government without research on their socio-economic impact in the context of its macroeconomic management policy role. Accumulating debt stock, inefficiency of the public service and poor government revenue are the corner stones for such criticism. These relate to issues on the budget administrators and not on the public service and budget per se. The criticism is generally based on routine economic numbers such as the budget deficit and public det trend in proportion to the country GDP, GDP growth, employment rate and poor quality and corruption of public services which are the numbers subject to immense controversies based on sources of data and creativity. There is a lot of scattered statistics on the delivery of various public services. Such statistics are not designed to assess the socio-economic impact of each public service or in aggregate of the public service sector. In general, direct and indirect impact of the public service to the society is enormous. Nobody can live without public service. Everybody wants the support of the government/public service to have a good life. All including the economists recommend the government to fix all macroeconomic and social ills whether it is general inflation or high cost of living or low economic growth or balance of payment (BOP) deficit or currency depreciation or unemployment or household income disparity or environmental problems or recovery from wars or disasters (floods, droughts, earthquakes) or social backwardness.

Some ambitious economists, while recommending the government to fix all structural economic problems such as chronic balance of payments deficits or poor exports or inflation, they simultaneously recommend the government to scale down the public service and budget as the solution. Nobody seems to talk about how various segments of the public benefit economically and socially from the public service and budget or its actual socio-economic impact when the government/public service is criticized. The budget is the reflection of the size and the quality of the public Service in the country. Therefore, before we criticize the public service and budget, we have to assess its socio-economic impact and whether it is justified, given the circumstances applicable to the country. The generation of employment, spending and income, maintenance of law and order, supply and maintenance of economic infrastructure, promotion of human resources through education and health services at low cost, fair markets through regulations, social safety net and supply of safer investments through state debt have to be assessed with a transparent set of data. In fact, the monetary and financial system prevails on volume of state debt, debt instruments and their yields as benchmarks for risk premium for private debt where the central bank prints and control money stock primarily through government debt market. However, this assessment is not available from the state budget authorities and respective public service institutions.

At micro-level, the government does not have a list of all public services, their end-service deliverables, their annual targets and performance level and cash flows. Therefore, overall budgeting and management in the context of service performance and cash flows with a macroeconomic management perspective have been become extremely difficult and become an exercise of number crunching. The wide allegations of corruption and excessive public spending are made without research on macroeconomic impact of the wider public service. Corruption that results in stealing public funds by way of tax evasion and over-estimated public expenses also benefits a section of the public. In fact, total fiscal spending in the country’s GDP, generally below 20%, would be relatively smaller and productive if such an assessment is made.

A Few Remarks

Overall, development of any country crucially depends of the efficacy of macroeconomic management by the government through its public service. Structural weaknesses of public service delivery system as compared to the market mechanism remain as the major bottleneck for the development of many countries. Therefore, public sector reform or modernization is considered as a key precondition for the development of any country. With the wider recognition of market-based economic principles since 1980s, almost all countries have adopted public sector reform agenda at a gradual phase to facilitate the economic development through the greater market mechanism.

The reform is a word introduced by multinational agencies such as IMF and World Bank to mean reorganization and restructuring of public services to facilitate economic/business activities largely through market mechanism. Such reform agenda prescribes privatization and commercialization of state enterprises and process-improvements to modernize and fast-track various bureaucratic operations. The reform process is a country-specific exercise as there are no recognized benchmarks commonly acceptable across the countries as the underlying environment of public service, political system and social values differ across the countries. Although everybody criticizes public services, everybody criticizes reform too while attempting to maintain the status quo, despite the criticism on the prevailing public service delivery systems. As a result, reform is always agitated by politicians, labour unions and public interest groups while only very few in the governments who favour market principles and private investments support reform.

Therefore, reform is a very slow process that takes decades and decades. During the past 50 years, reform process has been considerable, and it will probably take another 50 years to address current issues of corruption and bureaucracy. In public service, nothing can be reformed or innovated in one to two years. For example, even a transfer of a Head of a public institution will take more than one year to have the conditions settled in the institution after unintended stresses and allegations that happen consequent to the transfer. If the transfer is challenged at the judiciary, the planned reform agenda will invariably disappear. All governments come into power promising reform in public sector and socio-economic policies. However, when the new government starts touching reform after talking and compiling professional reports and committee reports, three-to-four years may have elapsed and the government has already become unpopular pending the next election that has come at the door-step. Reform agenda is also seen as a means to a new form of corruption to facilitate a segment of parties who are supporting the incumbent government, especially the parties who have financially supported and sponsored the political campaign of the incumbent government to win the election.

Then, the government’s next and best strategy is to forget reform and get ready for the next election after offering a new round of welfare-based public service to target votes. It is well known that if the corruption is heavily fought at a faster rate under reform agenda, economic progress will become standstill due to recessive public investments and operations as the fiscal front and debt have been the back-bone of many economies. As reform is seen or perceived to be negative or painful in minds of the most public although everybody talks on the need for reform, it may be useful to find a new word for reform such as innovation or public-friendliness improvements to mean a public-supportive activity. For example, when the draft bill for new legislation for the tax cut in the US tiled as Tax Reform Bill of 2017 was presented to the President Donald Trump for his concurrence before submitting to the Senate and Congress, he advised the team that nobody understand the word “reform” and, therefore, to change the name as Tax Cuts and Jobs Bill of 2017, the message of which was very clear to the general public.

Given the nature of public service that men govern men, nobody can expect all elected leadership and public servants to behave like the god. This is well understood from the thoughts of James Madison, 4th US President during the period March 1809-March 1817, referred to as the father of the US constitution. “If men were angels, no government would be necessary. If angels were to govern men, neither external nor internal controls would be necessary. In framing a government which is to be administered by men over men, the great difficulty lies in this: you must first enable the government to control the governed; and the next place oblige it to control itself.”

Therefore, the public service or intervention of the government in public for so-called public benefit/welfare is not just a composite of employment of a set of people, but it has to carried out in compliance with a large number of principles and rules including public trust doctrine which must be clearly set out and understood by those public servants and the general public. Although there is a large number of legal pieces to prevent abuses of public service and punish those who abuse, the public knowledge and implementation of laws are at poor condition in view of concerns eternally raised over the manner in which public service is delivered in almost all countries.

Therefore, it is necessary to educate the general public over each type of public service and intended safeguards. Further, public servants must be trained regularly on principles and procedures on delivery of public services in addition to training on technical subjects involved in public service. Modern words of good governance such as integrity, transparency and accountability are some concepts that help improve the delivery of public service in fair and impartial manner. However, the failure of the government intervention in or regulation of public is not a secret. As a result, the distortion happening in the market mechanism could be worse than concerns over the market mechanism and, therefore, the price, quality, quantity and distribution of output could be worse than in the market mechanism.

Central banking also falls into the public service and, therefore, almost all concerns and environment of public service are equally applicable to central banks too. The major difference here is that central banks have a greater operational and financial independence from governments as compared to other state/public institutions, given their monopoly to print money in the conduct of monetary and financial policies. Therefore, printing of money may be subject to enormous abuses including policy mistakes due to the flexibility of operations and strict confidentiality of information. Therefore, it is advisable that central banking authorities assess their processes adopted for policy-making and approvals falling under their purview to ensure that the public accountability and trust in the macroeconomic management role of central banks are upheld while minimizing the room for public concerns and allegations applicable to public service.

Therefore, it will be remarkable if central banks are able to compile a detailed list of their public services, set targets, determine responsibilities of line managements and assess performance on targets at least quarterly along with specific reasons for deviations from targeted performance. The communication of such performance results will ensure independence, transparency and accountability of central banks. If results persistently deviate from announced targets, the accountability should come in for officials responsible to step down from respective public posts. Central banks also are continuously under various reform and modernization processes in respective countries and, therefore, governance and policy environment vary across central banks although most of them attempt to talk by similar language on implementation and effectiveness of central banking functions and policies. However, unlike in other types of public services of wide diversity, the fact finding on the mission, principles, issues and effectiveness of central banks remains broadly applicable to most central banks since their public authority, objectives, functions, duties and governance environment look broadly similar.

In review of public service or macroeconomic management and economic and social development in the world, the contribution of the private sector/markets made through inventions, technology, mobilization of resources, production and trade to the world, despite bureaucratic bottlenecks and red tapes, has been extraordinary. Certain corporate leaders have been behind this world development. When compared to how private markets produce inventions to further improve the quality of human life, the status of the public service with all mighty powers of the governments is pathetic, despite highly educated crowd of public servants. In general, most of best performers at national examinations join the public sector. However, governments are innovative to create civil wars, country wars and world wars and to develop mass-killing weapon industry from ancient civilizations. The corruption has become the self-interest that drives all corners of the public service. Therefore, governments must critically review the goals and instruments of public service institutions in the light of the contribution they have made to the human being as compared to the private markets/private sector and innovate and realign the sector to produce for improvement of the quality of life of the people on side by side of the private sector. The size of the fiscal budget and budget deficit and public debt as compared to the private sector are the deciding factors in order to keep the government aligned to the size of the real economy.

In fact, money, banking and central banking have been invented by the private markets. Therefore, the government must value and facilitate the on-going private market innovations in monetary front as the government cannot keep the money under its control as a part of public service. Innovations in money and banking also can immensely improve the quality of human life further.

(This article is released in the interest of participating in the professional dialogue to find out solutions to present economic crisis confronted by the general public consequent to the global Corona pandemic, subsequent economic disruptions and shocks both local and global and policy failures. All are personal views of the author based on his research in the subject of Economics.)

P Samarasiri

(The author is a former Director of Bank Supervision, Assistant Governor, Secretary to the Monetary Board and Compliance Officer of the Central Bank, Former Chairman of the Sri Lanka Accounting and Auditing Standards Board and Credit Information Bureau, Former Chairman and Vice Chairman of the Institute of Bankers of Sri Lanka, Former Member of the Securities and Exchange Commission and Insurance Regulatory Commission and the Author of 12 Economics and Banking Books and a large number of articles published. He holds BA Hons in Economics from University of Colombo, MA in Economics from University of Kansas, USA, and international training exposures in economic management and financial system regulation).