Rising interest rates and declining export demand are dampening the economic resurgence of numerous Asian economies in the aftermath of COVID-19. But for Sri Lanka, the only country in the region to default on its official debt amid the economic squeeze caused by the pandemic however the outlook is considerably brighter.

Sri Lanka is experiencing a positive shift as tourism revenue and remittances from overseas Sri Lankan workers make a vigorous comeback.

Inflation, which had spiked to 70% last September, has retreated to a 6.3% level as of July. Consequently, the Central Bank of Sri Lanka has implemented a substantial reduction of 4.5 percentage points in its benchmark interest rate since June.

The default observed last year was the outcome of a combination of factors that drained Sri Lanka's foreign exchange reserves. The tourism sector, previously contributing nearly $5 billion annually in foreign exchange earnings, plummeted following the 2019 Easter Sunday incident.

The subsequent impact of COVID-19 hindered the return of visitors. Investor confidence and the country's macroeconomic standing suffered due to significant external borrowing, tax reduction measures, and internal political discord.

"President Ranil Wickremesinghe quickly took measures to stabilize the situation by opening talks with the International Monetary Fund on a loan and getting interim support from regional neighbors like India." said Kamil Kuthubdeen, Chairman of Global Business Trust LLC Dubai.

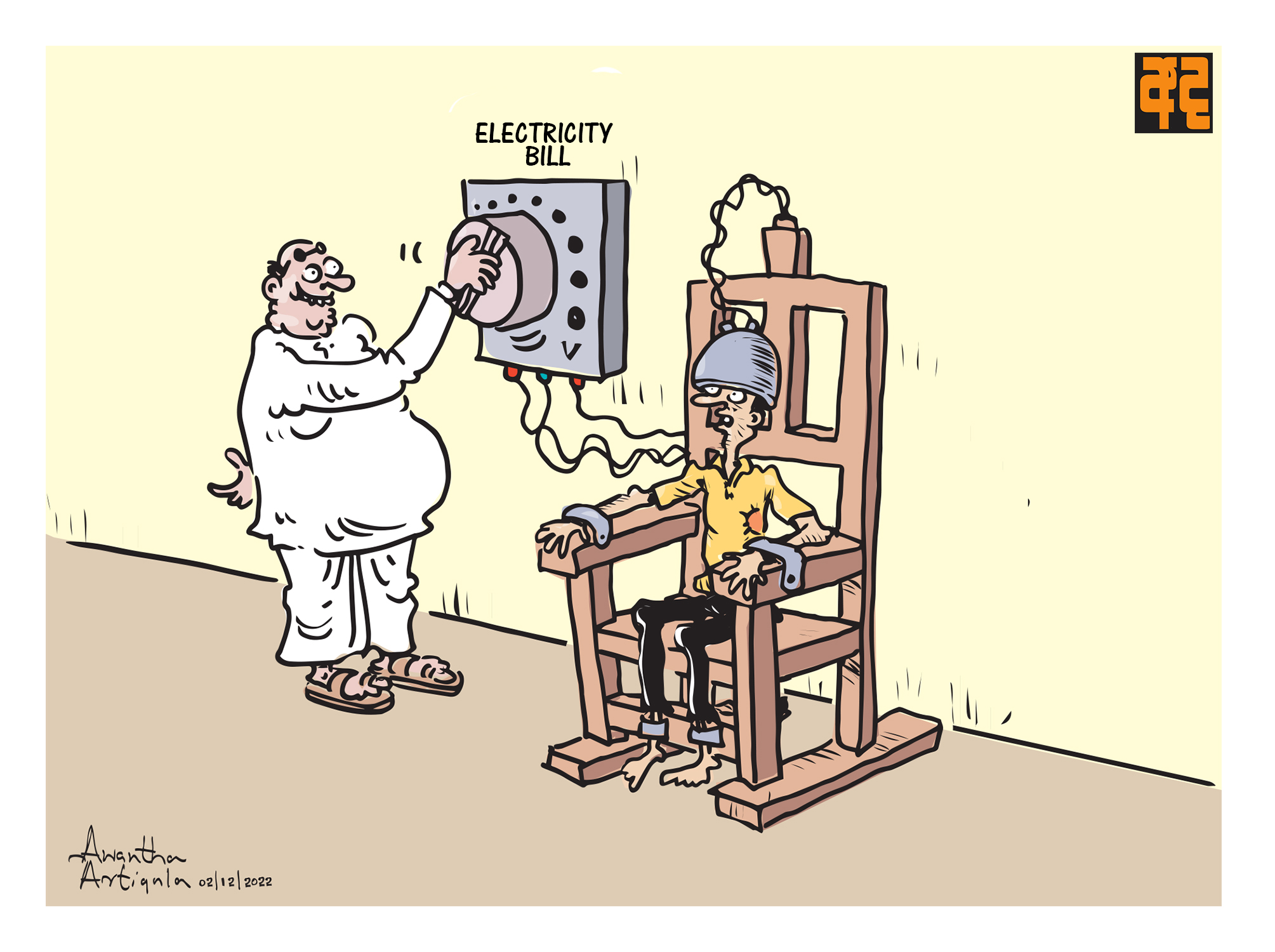

"To win the IMF's support, Colombo took hard but much-needed steps to increase fuel and electricity prices as well as raise tax rates and extend the tax net. A new central bank governor raised benchmark interest rates by 8 percentage points over the course of 2022 to try to put a lid on inflation and bring a degree of macroeconomic stability" Kamil Kuthubdeen added.

The eruption of the Ukraine conflict in the same year delivered a severe blow. Faced with depleting foreign reserves, Sri Lanka grappled with escalating expenses for imported food and fuel.

Hindered by doubts about its repayment capability and the global rise in interest rates, the nation was unable to turn to international capital markets to bolster its reserves.

Subsequently, the Central Bank of Sri Lanka resorted to printing money to cover the government's deficit. This had the unintended consequence of devaluing the Sri Lankan rupee and accelerating inflation.

The IMF, after granting approval for assistance to Colombo in March, predicts that Sri Lanka's current-account deficit will hover around 1.5% of its gross domestic product starting this year. This level is considered manageable and typical for a developing nation that relies heavily on importing fuel and food.

With a domestic debt restructuring initiative by the government, many uncertainties have been alleviated, particularly within Sri Lanka's banking sector. Colombo is engaged in talks with external creditors regarding the restructuring of the nation's external debt.

Furthermore, the government is actively pursuing its reform agenda by commencing the privatization of state-owned assets such as SriLankan Airlines and Sri Lanka Telecom.

Both the rupee and the national stock market have responded positively to recent macroeconomic progress, positioning them as some of this year's top performers.